December 2025 market update

Canada Life - Jan 08, 2026

Global markets ended 2025 on a cautious upswing, with resilient North American growth, soft demand in China, and record highs in key commodities shaping the outlook for 2026.

Introduction

Global equity markets finished slightly higher over the month of December. The U.S. Federal Reserve Board (Fed) lowered its policy interest rate in December, while signalling the possibility of another rate cut in 2026. However, positive sentiment was muted amid concerns the valuations of artificial intelligence stocks are too high.

Canada’s economy continues to demonstrate its relative strength despite ongoing trade tensions with the U.S. The labour market showed more signs of stabilizing towards the end of the year as the economy added jobs, helping to push the unemployment rate lower. The U.S. announced that its gross domestic product (GDP) expanded by 4.3%, annualized, in the third quarter of 2025. The U.S. inflation rate moved lower, raising hopes the Fed would keep cutting interest rates in 2026. The Fed lowered the target range of its federal funds rate by 25 basis points to 3.50%–3.75% at its final meeting of 2025.

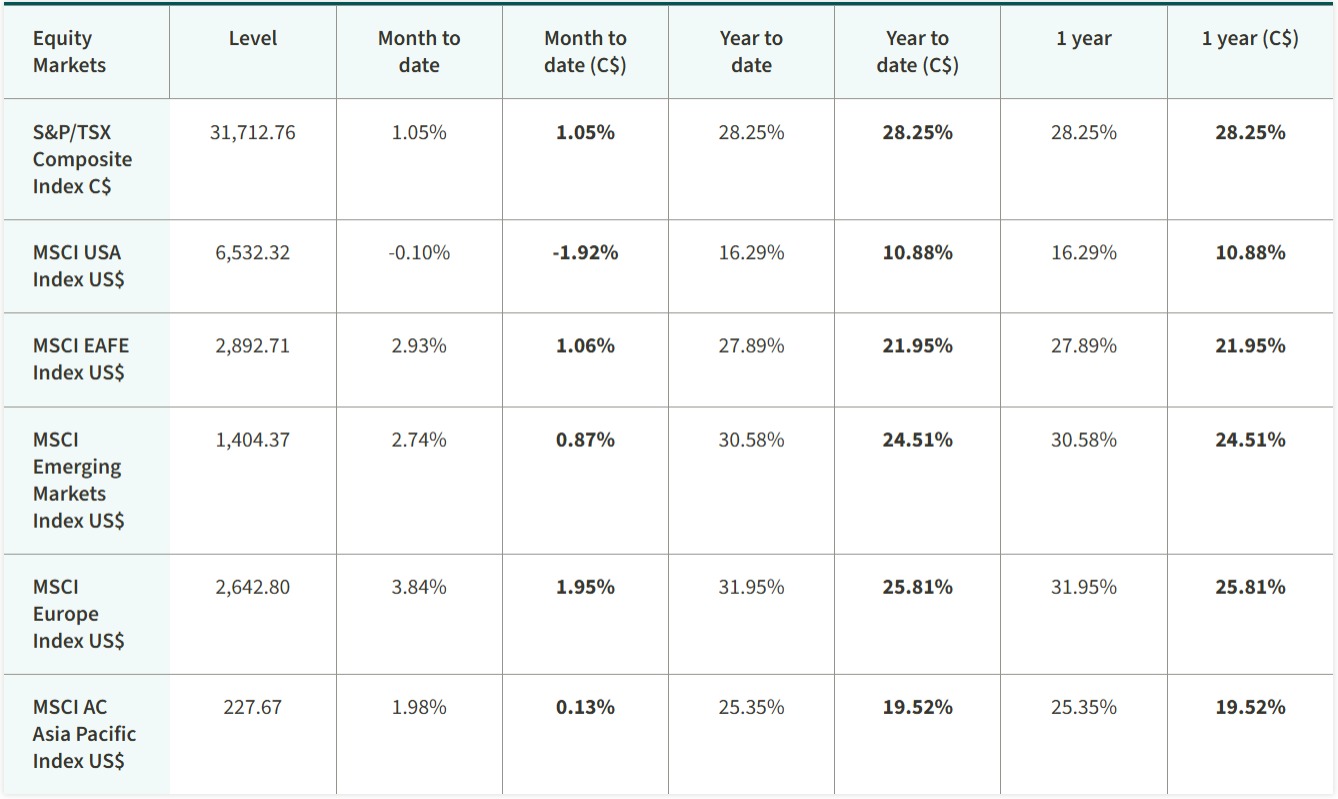

The S&P/TSX Composite Index edged higher, led by the financials sector. U.S. equities moved slightly lower. Yields on 10-year government bonds in Canada and the U.S. increased. Oil prices ticked lower, while the price of gold moved higher.

Better labour market conditions in Canada

After several months of showing signs of weakness, Canada’s labour market has shown signs of stabilizing over the past few months. As reported in December, Canada’s economy added 53,600 jobs in November, which surprised economists who were expecting the economy to lose jobs. This added to the 66,600 jobs gained in October and the 60,400 jobs in September. The part-time sector added 63,000 jobs, while the full-time sector lost 9,400 jobs. This marked the second straight month of full-time job losses. The health care and the accommodation and food services industries added a significant number of jobs over the month, offsetting job losses in the wholesale and retail trade industry. As population growth has slowed over the last few months, the labour force participation rate fell to 65.1%. At the end of November, Canada’s unemployment rate stood at 6.5%, which was its lowest level since July 2024. The Bank of Canada (BoC) held its benchmark overnight interest rate steady at 2.25% at its December meeting with the labour market stabilizing and inflation appearing to be largely contained. The BoC believes its policy interest rate is at an appropriate level to help support Canada’s economy and keep inflation close to its 2% target. The BoC did note that it would be willing to shift its policy stance if economic conditions do not evolve in line with its outlook.

U.S. sees fastest growth in two years

The U.S. economy grew more than expected in the third quarter of 2025, expanding at its fastest pace since the third quarter of 2023. U.S. GDP expanded at an annualized rate of 4.3% in the third quarter. The data release was delayed in response to the U.S. government shutdown. For the third quarter, there will only be two estimates compared to the usual three. The economy benefited from higher consumer and government spending, along with an increase in exports, while imports continued to fall amid extensive tariffs. The U.S. consumer continued to show their relative strength as household spending rose at its fastest pace this year. Net exports was another positive contributor, but there are reasons for caution. Many companies front-loaded imports ahead of tariffs, which has skewed some of the trade activity this year. Meanwhile, the U.S. inflation rate slowed to 2.7%, while the labour market shows signs of moderating. In response, the Fed lowered the target range of its federal funds rate by 25 basis points to 3.50%–3.75% at its December meeting. This marked the second consecutive rate cut by the Fed. Fed officials expect one more rate cut in 2026, but that could change as a new Fed Chair will come on board in 2026 and the U.S. economy continues to evolve.

Soft demand in China weighing on global economic activity

Muted domestic demand in China persists, which is weighing on economic growth both in China and other places around the world, particularly Europe. China’s retail sales rose by 1.3% on a year-over-year basis in November, which was the slowest pace of growth since declining in December 2022. Sales growth for food, sporting goods, clothing, and gold and silver moderated over the month. China’s government has taken notice and implemented several programs to help boost demand, which has done little to significantly boost domestic demand. But more help is on the way in 2026. Late in December, Beijing announced US$9 billion worth of stimulus measures to lift domestic demand, including extending its consumer trade-in program and providing subsidies for certain purchases, such as for electronics and smartphones. China’s own domestic economy has not been alone in feeling the effects of weaker domestic demand. The impact has spread to Europe, particularly its largest economy, Germany. Germany’s economy stalled in the third quarter of 2025 (0.0% growth) after declining in the second quarter, narrowly avoiding a technical recession. Detracting from growth was a drop in exports, particularly to the U.S., amid tariffs, and to China, in response to soft demand. Overall, economic activity remains relatively soft in Europe, expanding by 0.3% in the third quarter. Beijing believes that boosting domestic demand will help China’s economy, and by extension, help spur global economic activity. Given an integrated supply chain, better global economic activity elsewhere could have a positive impact on China’s own economy.

Gold, silver and copper prices rise to new records

Several key commodities hit record-high prices over the month of December as geopolitical tensions and expectations for supply and demand pushed prices higher. We start with gold, which continued its 2025 rally in December. Geopolitical tensions persisted, raising concerns about the global economy, which fuelled demand for gold by investors as they searched for a safe-haven asset. Additionally, expectations grew that the Fed would lower interest rates, perhaps multiple times, in 2026, spurring demand for the precious metal. Rising gold prices have helped the materials sector in 2025, making it the top performer on the S&P/TSX Composite Index. In addition to gold, silver and copper both rose to records in December. Both moved higher amid supply concerns. Copper, in particular, saw demand skyrocket as purchasers get ahead of tariffs. U.S. President Donald Trump has threatened to place tariffs on copper. Tariffs on copper have thus far been exempted, given its importance in the manufacturing process. Meanwhile, the price of oil edged lower over December. Concerns over supply heightened in response to tensions between the U.S. and Venezuela. However, this was partially offset by the Organization of the Petroleum Exporting Countries stating it will pause its production increases over the next few months.

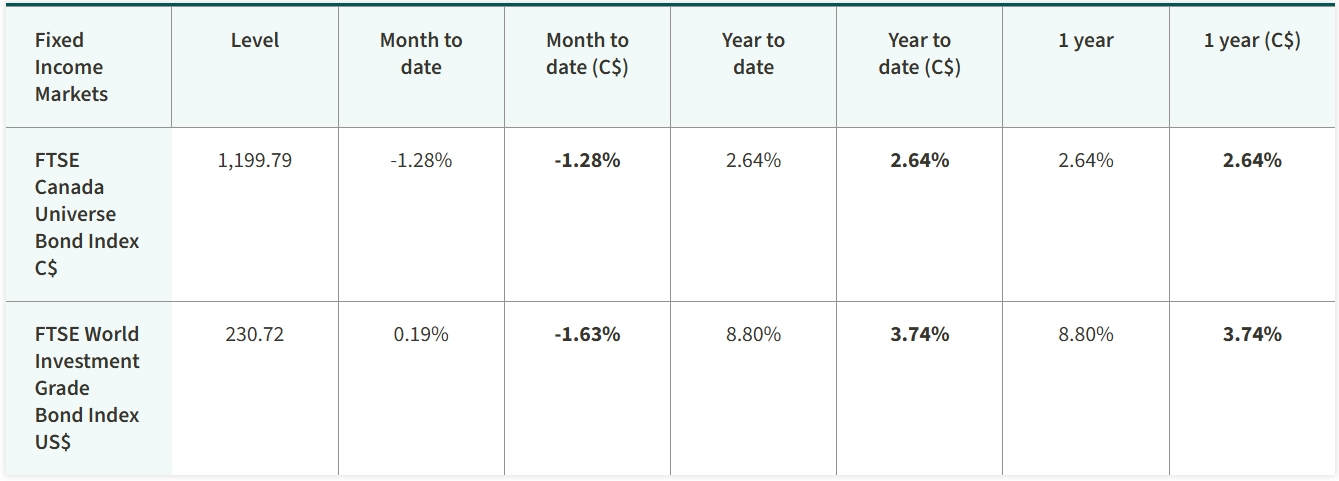

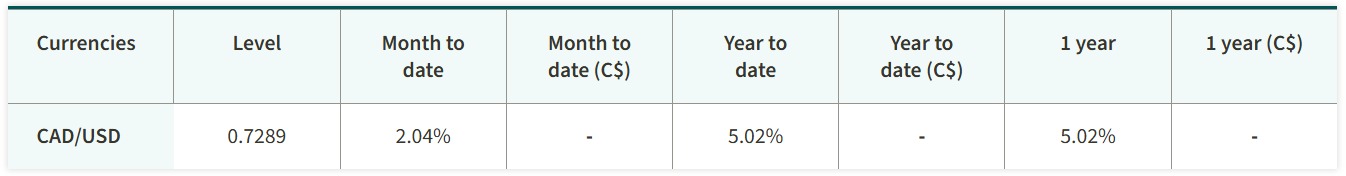

Market performance - as of December 31, 2025

This commentary represents Canada Life Investment Management Ltd.'s views at the date of publication, which are subject to change without notice. Furthermore, there can be no assurance that any trends described in this material will continue or that forecasts will occur; economic and market conditions change frequently. This commentary is intended as a general source of information and is not intended to be a solicitation to buy or sell specific investments, nor tax or legal advice. Before making any investment decision, prospective investors should carefully review the relevant offering documents and seek input from their advisor. You may not reproduce, distribute, or otherwise use any of this article without the prior written consent of Canada Life Investment Management Ltd.